There is always a need to keep increasing knowledge and acquiring skills of cross-sectional relevance in order to keep advancing in our career else our value in the world market will witness continuous depreciation.

We are not just talking of any skill, but highly profitable long-term skills that could take your portfolio from thousands to millions of dollars and more in less than 10 years.

One such skill acquisition course is the CFI Capital Market and Security Analyst Certification Course (CFI CMSA certification) offered by the Corporate Finance Institute.

Whether you are a chartered accountant, a business manager, or any other professional looking for greener pastures and better-paying jobs, the CMSA certification course is a good program for you.

But is the CMSA worth it? This is a common question aspirants like asking before investing in the course. And this question is what inspired this CMSA certification review that you are about to read.

I will be exposing every detail you need to know about the CFI CMSA certification such that after reading this post, you will be able to make an informed decision as to whether it is worth it or not depending on your personal career goals.

CMSA Certification Review: Is it Worth It?

The Capital Markets and securities analyst certification is an award you get after undergoing the CMSA course which was specially designed for learners who want to have a successful career in the capital markets.

This course is for anyone who is serious about gaining a deeper understanding of the various products and asset classes that make up the capital markets.

For every student who enrolls in the CMSA course, the Corporate Finance Institute provides experiential learning of not only technical knowledge but also real-world application of them. The CMSA program provides a comprehensive overview of fixed-income and accurate securities including commodities, foreign exchange, and their relatives.

What is so unique about the CMSA certification is the real-world tools of Wall Street Professionals. The CFI also invests a fortune to make sure that you have access to world-class teachers.

Whether it is a job you are looking for on the sell-side or the buy-side, fixed income, equities, foreign exchange, commodities, or derivatives this course is carefully crafted to help you have an edge over others. The CFI CMSA certification course teaches you the knowledge, techniques, and tools that the top Wall Street banks are looking for.

The CMSA Certification Course is self-paced, interactive, and immersive meaning that you can learn it at your own pace. It will give you the insider tips you need to begin a career and forge ahead in the capital markets industry.

CMSA Certification Requirements

To get the Capital Market and Securities Analyst certification, you must have completed all the CMSA courses and have aced your final exams.

This final exam is based on what you were though in the courses.

What You Will Find in the CMSA Courses

There are 36 courses and over 1940 lessons in the CMSA certification program. There are also over 230 interactive exercises that will help you learn by doing guided simulations.

The Prep Courses:

The prep courses are optional and were designed to help you prepare for the main program by reviewing the fundamentals of Capital Markets and Securities Analysis.

The Course Outline of the Prep Courses includes:

- Introduction to Capital Markets: this helps you to have a comprehensive overview of the capital market industry, the objectives of the capital market, and the key career opportunities. Here you will be learning about the sell side, buy side, and the respective popular and most lucrative career paths in each of the groups.

- Math Fundamentals for the Capital Markets: This includes fundamental mathematics like compound interest, future and present value, annuity, calculation of nominal rates and effective rates, conversion of present values to future values, and NPV.

- Economics for Capital Markets: This course is about the impact of economic principles on financial markets. You will be learning about economic indicators like leading indicators, coincident indicators, and lagging indicators as well as a rough guide on how a market should react.

- Foreign Exchange Fundamentals: Here you will be shown a background of the Foreign Exchange (FX) market.

- Excel Fundamentals – Formulas for Finance: You will be learning Excel shortcuts, functions, and formulas for financial modeling.

- Refinitiv Workspace Fundamentals: The Refinitiv Workspace Fundamentals is an introduction to the key features and functions of Refinitive workspace. You will learn how to create your own workspaces, how to access company information such as financials and estimates, and how to monitor stocks using the chart app.

The Core Courses

This is where the CMSA certification program gets serious. Here you will be exposed to 8 core courses to help you build a strong foundation in capital markets and securities.

Contents of the Core Courses include:

- Fixed Income Fundamentals: Fixed income fundamentals cover every detail you need to know about bond pricing, duration, and yield curve analysis. Key features such as par value, coupon, yield curves, and credit spreads will be introduced.

- Equity Markets Fundamentals: The fundamentals of equity markets include things like equity securities, stock exchanges, funds, valuation, and trade-offs of different investment strategies. Here you will understand the difference between risk and return, equities and funds, and you will recognize how stock exchanges work and the effects of pursuing certain order types. You will also be able to compare valuation and trading techniques along with different investment styles and strategies.

- Derivatives Fundamentals: Derivatives fundamentals include the basics of forward, futures, options, and swap contracts. In this course, you will be learning; the features of derivative contracts, over-the-counter vs exchange traded, forward contracts, futures contracts, initial and management margins, calls and put options, moneyness, and swap contracts.

- Spot Foreign Exchange: This includes the basics of foreign exchange, how to calculate fx rates and compare the different fx products.

- Commodities Fundamentals: Here you will be learning commodities categories, drivers, derivatives, and trading strategies.

- Hedge Fund Fundamentals: This section of the CMSA certification course gives a comprehensive overview of the hedge fund universe. After passing through this course, you be able to understand the characteristics associated with a typical hedge fund, explain the structure of a hedge fund, calculate management and performance fees, assess hedge fund performance, understand how short-selling works, and identify fixed-income arbitrage and event-driven strategy opportunities.

- Portfolio Management Fundamentals: Ever wondered what portfolio management entails? After this course, you will be able to manage both traditional and non-traditional portfolios, construct a portfolio, and also how fund performance is measured.

- Professional Ethics: Every profession has ethics including the Capital Markets and Securities Analyst. In this section, you will learn how to make better decisions using moral principles of integrity that constitute professional conduct.

The Elective Courses

These are additional courses you can choose from after you must have completed all the core courses. You are required by the CFI to choose a minimum of 7 out of 21 available elective courses in order to help you explore more advanced topics and specialized subjects.

If I were you, I wouldn’t mind taking all these elective courses as well as the prep courses. No knowledge is a waste, and you will be making good use of the money you invested in this CMSA certification program.

Some of the Elective CSMA Courses Include:

- How to trade using technical analysis

- Behavioral finance

- Swaps fundamentals

- Futures Pricing and Commodity Futures

- Equity, Foreign Exchange and Rate Futures

- Advanced Futures and Forwards

- Applied Fixed Income

- Advanced Fixed Income

- High-Yield Bonds, Subordinated Debt, and Loans

- Convertible bonds

- Short Duration Products

- Credit Fixed Income

- Repo (Repurchase Agreements)

- Securitized Products Part 1

- Prime Services and Securities Lending

- Origination Fundamentals – Debt Capital Markets Perspective

- Foreign Exchange Deliverable Forwards

- Understanding Options

- Modeling Risk with Monte Carlo Simulation

- Syndicated Lending

- Commercial Mortgages

Guided Case Studies

After you must have completed the core CMSA certification courses and at least 7 out of the 21 CMSA courses, you will then advance to the next section of the program. This section is called Applied Technical Analysis for Equity Markets. It will help you put what you have learned into practice by working through the database of the CFI real life case studies.

The Final CFI CMSA Certification Exam

Having studied the CMSA-guided case studies; you will now be qualified to take the CMSA final exam.

Get CMSA Certified

For you to get the CMSA certification, you are required to have scored a minimum of 70% in the CMSA exam. And upon completion of the program, you will receive a blockchain digital certificate with your new credentials.

You can as well order a physical certificate which would be delivered to your doorstep.

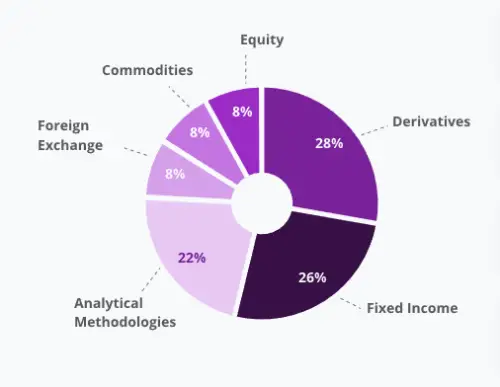

Summary of the Components of the Capital Markets and Securities Analyst Course:

- Derivatives

- How derivatives work

- How to manage the risk of financial derivatives

- Value and price derivatives

- Fixed Income

- Explanation of the basic concepts of fixed income

- Ability to compare different sub-classes of fixed income, including bonds, swaps, securitized products, and credit

- Ability to explain the investors, originators, and intermediaries involved in the fixed-income market

- How to identify risks and trade fixed-income securities

- Analytical Methodologies

- How to analyze securities, markets, and Players using Proven Frameworks

- How to apply the analytical methodologies when making investment decisions

- How to use the analytical methodologies in trading simulations

- Foreign Exchange

- Discussion of the Foundations of Foreign Exchange Markets

- Explanation of the various FX markets

- How to employ various markets strategies to enhance market returns and reduce market risks

- Commodities

- Definition of commodities and their important features

- How to identify the major commodity categories

- Discussion of the drivers of the commodities in different categories

- How to undertake commodity trading strategies using futures and options

- Equity

- Explanation of how cash equities work

- How to apply the fundamentals to equity derivative products and structures

- How to trade and risk manage institutional equities

CMSA certification cost and accessibility

There are two programs available for an intending capital markets and securities analyst; the Self-study and the Full-immersion programs.

Self-Study Course

Minus Real World Finance Tools.

- All the 36 CMSA Courses

- CSMA Certification

- Financial Models and Templates Library

- Quizzes, Assignments, and Tests

- Excel, PPT, and PDF files

- Digital Blockchain Verified Certificate

Full-Immersion Course

Plus Real World Finance Tools.

- All benefits of the Self Study Course plus

- Macabacus access

- Capital IQ access

- Refinitiv Workspace Access

- PitchBook Access

- Vertical IQ Access

- Premium Email Support

- Model Review and Feedback

- Additional Case studies

- FREE modeling completion entry

CFI CMSA Review: What are the Benefits?

- You have a hands-on learning experience to prepare you for your career as a Capital market and security analyst

- You have knowledge of the tools and techniques used by the professionals of Wall Street

- Specialized courses on FX, fixed income, equities, commodities, and derivatives

- Compared to other CMSA courses which you pay thousands of dollars to access, the CFI CMSA program is quite affordable

CMSA certification salary

Another thing that will determine if the CMSA certification is worth it is the ROI. You should be interested in knowing how much you can make as a Capital Markets and Securities Analyst. The average capital markets and securities analyst salary is around USD$16,765 – USD$453,332 per year. This is more than the average salary of some doctors in the United States, making a CMSA one of the highest-paying certification courses.

CMSA Certification jobs

After getting your certificate, you can use to apply for the various CMSA certification jobs available near you.

CMSA Certification Jobs you can apply for Include:

- Commercial banks

- Investment banks

- Pension funds

- Insurance firms

- Mutual funds

- Portfolio manager

- Any financial institution

You will find most CMSA certification jobs in large cities like New York City, Washington, Los Angeles, and Chicago in the United States, London in the United Kingdom, and Geneva in Switzerland. However, you can as well work remotely from home and still make a decent income as a capital markets and security analyst.

The job outlook for securities analysts is projected by the Bureau of Labour Statistics to be excellent. In fact their jobs are expected to grow by 11% in the nearest future. This is much more than the average rate.

Final Words! Is CMSA certification worth it?

From every indication, the CMSA certification course will boost your career and make you better suited for very high-paying jobs in the financial markets industry. So it is definitely worth every dime you spend on it.

FAQs

What Does a Capital Markets Analyst Do?

A capital markets analyst collects, analyzes, interprets, and communicates data for the development of market reports and strategic recommendations on individual securities for their financial organization. They also provide investment management services, lending services, equity sales and trading, consulting services, and research.

How long are you expected to take the CMSA Certification Course?

Although you pay to have access to the CMSA courses on a yearly basis, you can actually complete all the courses at your own pace and earn your certification before the one year access period elapses. However, in the case where you are unable to complete the course within one year, you will have to renew your subscription to have access to the courses for the coming year.

When Is the CMSA certification renewal?

The access to the CFI CMSA course expires after one year. To continue having access, you have to renew the program for the coming year.

Also, Read; CFI Business Intelligence and Certification Reviews